Epistemic status: Confident that the effect is real, though likely smaller than suggested by the toy-model.

Summary

Small donors should discount the cost effectiveness of their donations to interventions above a large funder’s bar if

- they expect the large funder not to have spent all their capital by the time of AGI’s arrival[1][2]

- their donation to interventions above the large funder’s bar funges with the large funder.

In this post I describe a toy model to calculate how much to discount due to this effect.

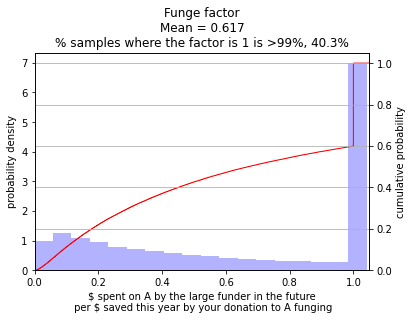

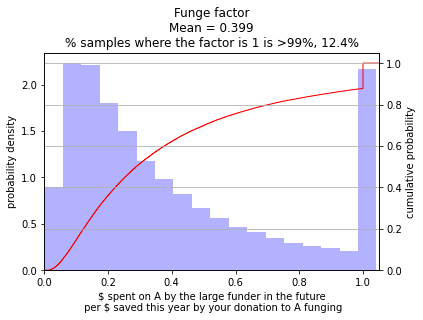

I apply the model to a guess of Open Philanthropy’s spending on Global Health and Development (GHD) with Metaculus’ AGI timelines (25% by 2029, 50% by 2039). The model implies that small donors should consider interventions above OP's GHD bar, e.g. GiveWell's top charities, are only 55% as cost effective as the small donors first thought. For shorter AGI timelines (25% by 2027, 50% by 2030) this factor is around 35%.

I use OP's GHD spending as an example because of their clarity around funding rate and bar for interventions. This discount factor would be larger if one funges with 'patient' philanthropic funds (such as The Patient Philanthropy Fund).

This effect is a corollary of the result that most donor's AGI timelines (e.g. deferral to Metaculus) imply that the community spend at a greater rate. When a small donor funges with a large donor (and saves them spending themselves), the community's spending rate is effectively lowered (compared to when the small donor does not funge).

This effect occurs when a small donor has shorter timelines than a large funder, or the large funder is not spending at a sufficiently high rate. In the latter case, small donors - by donating to interventions below the large funder's bar - are effectively correcting the community's implicit bar for funding.

Toy model

Suppose you have the choice of donating to one of two interventions, which gives utils per $, or , which gives utils per $. Suppose further that the available interventions remain the same every year and that both have room for funding this year.

A large funder will ensure that is fully funded this year, so if you donate $1 to , then , effectively, has $1 more to donate in the future. I suppose that only ever donates to (opportunities as good as) .

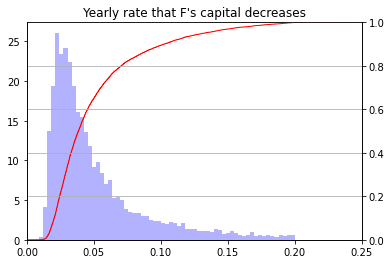

I suppose that 's capital decreases by some constant amount times their initial capital each year.[3] This means that will have no assets in years from now.

Supposing AGI arrives years from now, then F will have spent fraction of their current capital on .

Accounting for this funging and assuming AGI arrives at time , the cost effectiveness of your donation to is then utils per $. Then if , marginal spending by small donors on is more cost effective than on .

By considering distributions of AGI's arrival time and the large funder's funding rate we can get a distribution of this multiplier.

Plugging in numbers

I take

- The large funder to be Open Philanthropy’s Global Health and Wellbeing spending on Global Health and Development and intervention to be Givewell’s recommendations.

- I take , the expected time until OP's funds dedicated to GHD are depleted to be distributed bounded below by 5.[4]

- I take AGI timelines to be an approximation those on Metaculus.

These distributions on AGI timelines and give the following distribution of the funging multiplier (reproducible here).

The ratio of cost effectiveness between GiveWell's recommendations and GiveDirectly, , is approximately 7-8 [5]and so small donors should give to interventions in the (5, 7)x GiveDirectly range.

For donors with shorter timelines AGI timelines (25% by 2027, 50% by 3030) one should discount more.

Thanks to Tom Barnes for comments.

- ^

And you believe that there is no use for capital post-AGI.

- ^

One could also compute the analysis for any (existential) catastrophe that either affects the funder's ability to donate or the existence of interventions to give to.

- ^

An earlier version of the model considered appreciation of capital and constant spending on , though I have cut for simplicity to avoid discussion of patient

One could, for example, suppose that their capital is measured in "ability to do good" and that the interventions become more expensive as quickly as their capital appreciates.

- ^

This is some data and a lot of intuition.

In July 2022 Open Philanthropy wrote

Our current best estimate is that, for interventions like GiveWell’s recommended charities, our optimal strategy is to spend 8-10% of relevant assets each year.. This means that whatever level of assets we have, our cost-effectiveness “bar” for GiveWell-like interventions should be set so that the opportunities above this bar in the next year add up to 8-10% of such assets.

My distribution on implies they have roughly 20% change of meeting or exceeding this target.

Eyeballing some historic spending and guesses of Dustin Moskovitz's wealth pus their historic spending rate at around 2-5%.

The lower bound is based on my current impression that OP's GHD team do not plan to spend all their funds within the next 5 years. A distribution other than trunctated normal would likely be more appropriate.

- ^

Open Philanthropy, November 2021

Overall, we currently expect GiveWell’s marginal cost-effectiveness to end up around 7-8x GiveDirectly (in their units),

Thanks for the post! I thought it was interesting and thought-provoking, and I really enjoy posts like this one that get serious about building models.

One thought I did have about the model is that (if I'm interpreting it right) it seems to assume a 100% probability of fast takeoff (from strong AGI to ASI/the world totally changing), which isn't necessarily consistent with what most forecasters are predicting. For example, the Metaculus forecast for years between GWP growth >25% and AGI assigns a ~25% probability that it will be at least 15 years between AGI and massive resulting economic growth. I would enjoy seeing an expanded model that accounted for this aspect of the forecast as well.

Thanks :-)

Good point! The model does assume that the funder's spending strategy never changes. And if there was a slow takeoff the funder might try and spend quickly before their capital becomes useless etc etc.

I think I'm pretty sold on fast-takeoff that this consideration didn't properly cross my mind :-D

Here's one very simple way of modelling it

Conditioning on AGI at t:

Hence the cost effectiveness of a small donor's donation to A this year is min(ft,1)+[1−min(ft,1)]⋅ps⋅c times the on-paper cost effectiveness of donating to A.

Taking

gives the following result, around a 5pp increase compared to the results not factoring this in.

I think this extension better fits faster slow-takeoffs (i.e. on the order of 1-5 years). In my work on AI risk spending I considered a similar model feature, where after an AGI 'fire alarm' funders are able to switch to a new regime of faster spending.

I think almost certainly that s<1 for GHD giving. Both because

(1) the higher spending rate requires a lower bar

(2) many of the best current interventions benefit people over many years (and so we have to truncate only consider the benefit accrued before full on AGI, something that I consider here).