For anyone donating their income, being aware of tax rules and making proper use of available deductions can result in significantly increased donations. There are some existing resources on US tax rules (e.g. Ben Kuhn's post), but I hadn't come across any for UK tax rules yet.

So in the hope of saving someone else (and future me!) some time, here's my current understanding. If you'd like to share this with others, there's a less EA-oriented version of this post on my personal blog. All the calculations and charts are in this spreadsheet. There's also a personal tax calculator tab in the spreadsheet.

Note: I'm not an accountant, and I'm definitely not qualified to give tax advice. Almost everything here comes from the tax relief section on the gov.uk website. Before making any decisions, check that what I've written is correct and applies to your situation! If you spot any mistakes, please let me know and I'll do my best to correct them. Tax thresholds and rates here are for 2018/2019. Scotland has different rates.

Summary:

- UK charitable donations are fully tax-deductible.*

- Some of the tax relief can go to your chosen charity automatically (i.e. 'Gift Aid').

- You might be eligible for extra tax relief, which you can claim back by asking HMRC to reduce your tax bill.

- Extra tax relief can be significant! Depending on your tax rate, tax relief can give you a 1.25x-2.5x donation multiplier.

- There's some flexibility around which tax year you account for donations in. If you're earning less this year than last year you might be able to significantly reduce your tax bill this way!

One key income bracket is £100-123.7k. If you're in this bracket, you're paying an effective marginal tax rate of 60%! So for example you could make a £20k donation by giving up only £8k.

How UK Income Tax Works

UK income tax is progressive, i.e. increases with income.

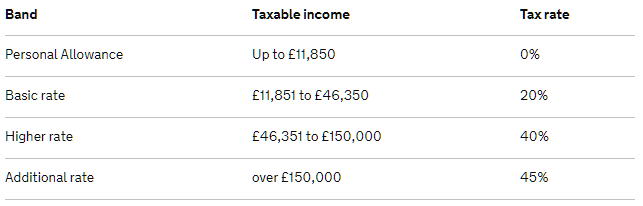

UK income tax brackets 2018/2019 (source)

The chart below shows what total income tax looks like for various income levels, and how that breaks down into the various bands. I've included data up to £200k since beyond that it just goes up linearly, and if you're in that band you might consider investing in proper tax advice!

Interactive version of this chart.

A few things you'll notice about the chart:

- If you earn less than £11.85k per year, you pay no tax.

- As you go further to the right from there, you always pay more tax overall.

- The top line generally gets steeper as you go right, but this isn't true everywhere.

- The steepest part of the chart is between £100k and £123.7k, where you gradually lose your personal allowance.

The steepness of that top line represents your marginal tax rate - i.e. how much tax you'll pay on every extra £1 you earn at that level. This is a useful thing to look at, because it affects the 'donation multiplier' you'll get at that level - i.e. how much your chosen charity will get for every £1 in net income you give up.

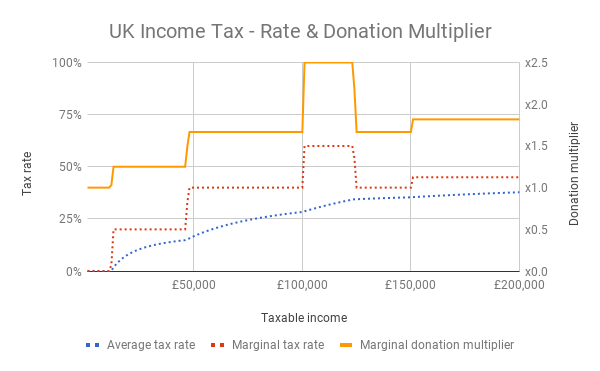

Here's another chart which shows that relationship more clearly:

Interactive version of this chart.

What does this second chart show? The yellow line shows the donation multiplier for £1 at each level:

- When you earn below £11.85k, your donation multiplier is x1. This makes sense, since there's no tax to deduct. For every £1 you give to charity, you lose £1.

- When you earn £11.85k-£46.35k, your donation multiplier is x1.25. In this bracket your tax deduction is fully taken care of by Gift Aid, so all you have to do is remember to tick that box when you donate and the charity gets an extra 25% directly from the government.

- In the bracket £46.35k-100k and again from £123.7k-£150k, your donation multiplier is x1.67. At this point the 25% in Gift Aid doesn't fully cover your tax deduction, so you get to claim back some extra tax from HMRC (see below for more on how to do this).

- At £100k-£123.7k, not only are you in the top 0.1% of global earners, but you've hit the donation multiplier sweet spot of x2.5. You can more than double your money with every donation! This is because you'd be paying 40% in tax while your personal allowance would be reduced by 50p for every £1 increase in your salary, resulting in an effective 60% marginal tax rate. Again, you'll get to claim back a lot of tax on any donations.

- Beyond £150k - congrats! You're comfortably in the top 0.1% of the global population, earning almost 150x the global average salary. Not only that, your donation multiplier is x1.8, so you only give up 55p for every £1 you give to charity. And giving to charity can raise your tax-free pension allowance.

How to claim tax back

If you're a basic rate taxpayer (i.e. your total taxable income is up to £46.35k) then you don't need to worry about claiming tax back - Gift Aid takes care of it.

Beyond that there are three options I'm aware of: Payroll Giving, doing a tax return, or asking HMRC to change your tax code.

Payroll Giving is great, but your employer needs to be set up for it. If they are, then all you need to do is tell your employer your intended monthly donation. They'll take it straight out of your gross salary and give it to your charity of choice, without any tax being deducted.

If you fill in a Self Assessment tax return, there's a section on charitable donations. Doing one isn't exactly fun, but it's not as difficult as it sounds (and I've heard it's much easier than the US system!). All your employer's data will be imported already, so you only need to fill in additional details on your donations and any other relevant sections. If you're doing regular donations then the next option is probably better for you, but if you want to be able to do things like optimising the tax year of your donations then you'll need to fill in a Self Assessment tax return. And if you earn over £100k you'll have to do one anyway.

Until fairly recently, I thought those were the only two options. It turns out there's a third one! If you give regularly and don't fancy filling in a tax return, you can just ask HMRC to change your tax code. All you need to do is tell them how much you're donating every month, and they'll change your tax code to increase your personal allowance - thereby reducing the amount of tax you'll pay. I think you can probably do this over the phone, but I found their online chat function easy enough. (obviously always make sure you keep a record of all your donations)

When to claim tax back

There's a pretty useful rule which can allow you to claim tax back on donations made now as if they were made in the previous tax year (assuming you're filling in a Self Assessment tax return). This is great if:

- you're earning a lot this year, but unsure on where/how much you want to donate. You could hold off on donating until just before you submit your tax return.

- you paid a higher marginal tax rate last year than you expect to pay this year, so could increase your effective donation by submitting it in last year's tax return.

Why does this work? When you fill in a Self Assessment tax return, you do that for the previous tax year (April-April). And you have until January 31 in the following year to do this (i.e. almost 10 months after the end of the tax year).

You're allowed to account for donations made in the current year as if they happened last year. Specifically: "you can also claim tax relief on donations you make in the current tax year (up to the date you send your return) if you either: want tax relief sooner, or won’t pay higher rate tax in current year, but you did in the previous year".

Other things to consider

- Which charities will maximise the impact of your donations?

- Should you give now or give later?

- How much should you give right now? Hopefully this post helps clarify the tax aspects of that. You can find the spreadsheet behind each of the charts here (and 2017/2018 version here), including a calculator sheet for any given income/donation amount. Many people have signed the Giving What We Can pledge to donate 10% or more of their income for the rest of their lives.

- Could you donate appreciated assets (like property, shares, or bitcoin) instead of income? In this case you can get Gift Aid on both income tax and capital gains tax.

- Some employers will match your donations, doubling your donations again with no extra effort involved.

- If you don't live in the UK, you'll obviously have to follow different rules. Ben Kuhn has a great post on giving in the US.

- If you're earning a lot but aren't sure where to give yet, consider setting up a donor advised fund.

- Is earning to give (i.e. maximising your income and resulting donations) the most promising career path for you? Are there other things you should be considering if you want to maximise your impact on the world?

* In this post I've focused on income tax. I haven't taken into account National Insurance payments in any of the calculations, as these aren't deductible. I also haven't modelled the impact on other things like student loan repayments or pension allowance increases. As for income tax, there are some limits to the amount you can claim back, but they're quite high - "Your donations will qualify as long as they’re not more than 4 times what you have paid in tax in that tax year".

Thanks Harald, this is a terrific article and should be required reading for all UK donors. I love the graphs in particular and the content looks accurate to me. I think gift aid and tax relief are important considerations which increase the benefit of giving now relative to giving later- particularly for higher rate taxpayers. In retirement, most people will have a significantly lower income than during working life, and very few people indeed are likely to be higher rate taxpayers in retirement and benefit for a 1.67 multiplier. There also seems to be little tax benefit to donating to charities in your will - unless you have a large estate beyond the high threshold for inheritance tax (effectively 650,000 for married couples) and presumably there is no gift aid on bequests except for any income tax you paid in your final year of life?